Ratings for Vertex Pharmaceuticals (NASDAQ:VRTX) were provided by 18 analysts in the past three months, showcasing a mix of bullish and bearish perspectives.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 4 | 5 | 9 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 1 | 0 | 1 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 3 | 4 | 8 | 0 | 0 |

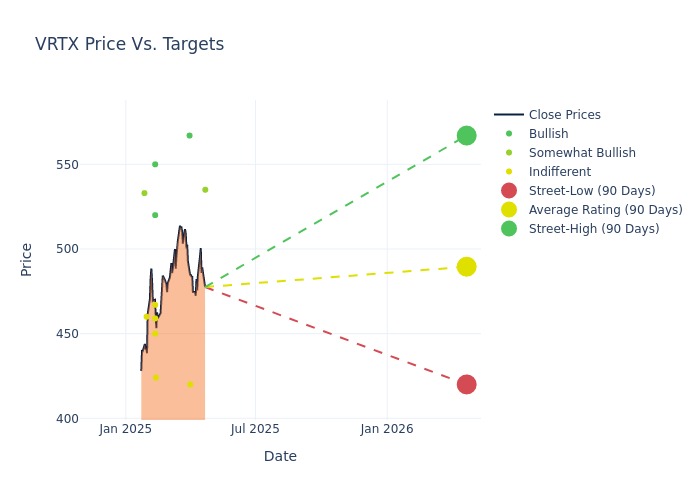

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $479.06, with a high estimate of $567.00 and a low estimate of $407.00. This current average has increased by 2.98% from the previous average price target of $465.18.

Decoding Analyst Ratings: A Detailed Look

The perception of Vertex Pharmaceuticals by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating |Current Price Target| Prior Price Target | |--------------------|--------------------|---------------|---------------|--------------------|--------------------| |Carter Gould |Cantor Fitzgerald |Announces |Overweight | $535.00|- | |Brian Abrahams |RBC Capital |Raises |Sector Perform | $420.00|$408.00 | |Ying Huang |B of A Securities |Raises |Buy | $567.00|$555.00 | |Brian Abrahams |RBC Capital |Raises |Sector Perform | $408.00|$407.00 | |Whitney Ijem |Canaccord Genuity |Raises |Hold | $424.00|$408.00 | |Joon Lee |Truist Securities |Raises |Buy | $520.00|$460.00 | |Brian Abrahams |RBC Capital |Raises |Sector Perform | $407.00|$402.00 | |Greg Harrison |Scotiabank |Raises |Sector Perform | $450.00|$433.00 | |Olivia Brayer |Cantor Fitzgerald |Maintains |Overweight | $480.00|$480.00 | |Gena Wang |Barclays |Raises |Equal-Weight | $467.00|$435.00 | |Andrew Fein |HC Wainwright & Co. |Maintains |Buy | $550.00|$550.00 | |Matthew Harrison |Morgan Stanley |Raises |Equal-Weight | $459.00|$450.00 | |Olivia Brayer |Cantor Fitzgerald |Maintains |Overweight | $480.00|$480.00 | |Greg Harrison |Scotiabank |Raises |Sector Perform | $433.00|$430.00 | |Andrew Fein |HC Wainwright & Co. |Raises |Buy | $550.00|$535.00 | |Mohit Bansal |Wells Fargo |Maintains |Equal-Weight | $460.00|$460.00 | |Christopher Raymond |Piper Sandler |Lowers |Overweight | $533.00|$535.00 | |Olivia Brayer |Cantor Fitzgerald |Maintains |Overweight | $480.00|$480.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Vertex Pharmaceuticals. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Analyzing trends, analysts offer qualitative evaluations, ranging from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Vertex Pharmaceuticals compared to the broader market.

- Price Targets: Delving into movements, analysts provide estimates for the future value of Vertex Pharmaceuticals's stock. This analysis reveals shifts in analysts' expectations over time.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of Vertex Pharmaceuticals's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on Vertex Pharmaceuticals analyst ratings.

Discovering Vertex Pharmaceuticals: A Closer Look

Vertex Pharmaceuticals is a global biotechnology company that discovers and develops small-molecule drugs for the treatment of serious diseases. Its key drugs are Kalydeco, Orkambi, Symdeko, and Trikafta/Kaftrio for cystic fibrosis, where Vertex therapies remain the standard of care globally. Vertex has diversified its portfolio through Casgevy, a gene-editing therapy for beta thalassemia and sickle-cell disease. Additionally, Vertex is evaluating small-molecule inhibitors targeting acute and chronic pain using nonopioid treatments, and small-molecule inhibitors of APOL1-mediated kidney diseases. Vertex is also investigating cell therapies to deliver a potential functional cure for type 1 diabetes.

Vertex Pharmaceuticals: Financial Performance Dissected

Market Capitalization: Positioned above industry average, the company's market capitalization underscores its superiority in size, indicative of a strong market presence.

Revenue Growth: Vertex Pharmaceuticals's remarkable performance in 3M is evident. As of 31 December, 2024, the company achieved an impressive revenue growth rate of 15.66%. This signifies a substantial increase in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Health Care sector.

Net Margin: Vertex Pharmaceuticals's net margin is below industry averages, indicating potential challenges in maintaining strong profitability. With a net margin of 31.35%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Vertex Pharmaceuticals's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 5.7% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): Vertex Pharmaceuticals's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 4.08% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.11.

Understanding the Relevance of Analyst Ratings

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.