Mettler-Toledo International (NYSE:MTD) experienced a significant price decline of 10% over the last week, a stark contrast to the general market, which rose sharply on Tuesday with the Dow surging over 1,000 points. This decline occurred despite broader gains spurred by positive earnings reports from companies like GE Aerospace and 3M. With the market rebounding from recent losses attributed to uncertainties around tariffs and central bank policies, the company’s stock movement may seem unusual. Markets posted a 4% overall drop last week, suggesting that specific factors might have influenced Mettler-Toledo's trajectory amidst ongoing economic uncertainties.

Be aware that Mettler-Toledo International is showing 2 risks in our investment analysis.

The recent 10% decline in Mettler-Toledo International’s share price amidst a market rally may raise questions about its future trajectory. While short-term factors appear to influence the stock, it's important to note that over the past five years, the company's total return, including share price and dividends, was 31.95%. During the last year, Mettler-Toledo outperformed the US Life Sciences industry, which experienced a 25.5% decline, highlighting relative resilience despite recent volatility.

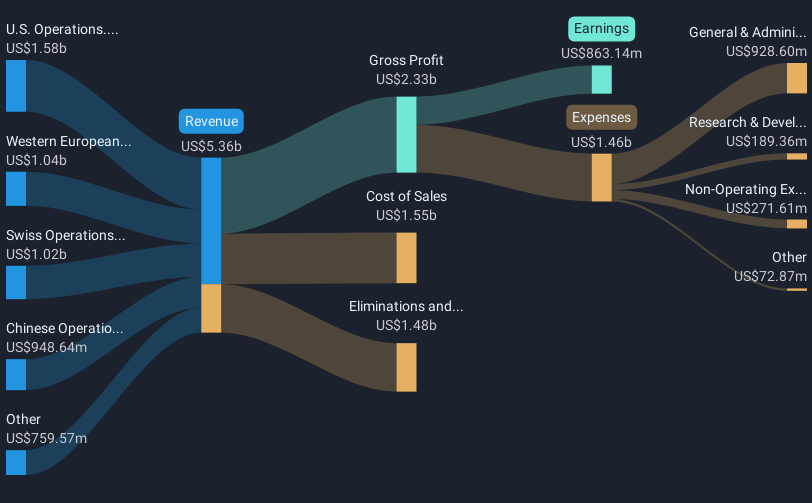

This downturn may impact revenue and earnings forecasts, particularly if concerns about geopolitical tensions and declining China sales persist. However, the company’s focus on automation, digitalization, and service sales might mitigate these risks, potentially stabilizing revenue growth and improving margins. As for the current price of US$1,016.65, it's noteworthy that it trades below analysts' consensus price target of US$1,339.96, suggesting potential upside of around 24.1% if forecasts hold true.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com