Regeneron Pharmaceuticals (NasdaqGS:REGN) announced a major expansion of its manufacturing capacity, including a $3 billion deal with Fujifilm Diosynth Biotechnologies and further investments at its Tarrytown campus. This expansion underscores Regeneron's commitment to growth within the biopharmaceutical industry and aligns with recent FDA approvals for products like Dupixent. However, the company's share price decreased by 2% over the past week, a move that might have been driven by broader market fluctuations rather than specific company-related developments, especially given the Dow's remarkable 1,000-point surge. In the broader market, conditions have been relatively flat, factoring into Regeneron's recent performance.

The expansion plans announced by Regeneron Pharmaceuticals, including the US$3 billion deal with Fujifilm Diosynth Biotechnologies, could significantly impact its future revenue and earnings forecasts. This expansion supports Regeneron's focus on personalized medicine and its robust pipeline, potentially enhancing the company's long-term growth trajectory. Investment in manufacturing capacity and recent FDA approvals might bolster the company's market penetration, potentially translating into increased revenue streams and earnings stability. However, these outcomes are contingent on successful execution and market conditions.

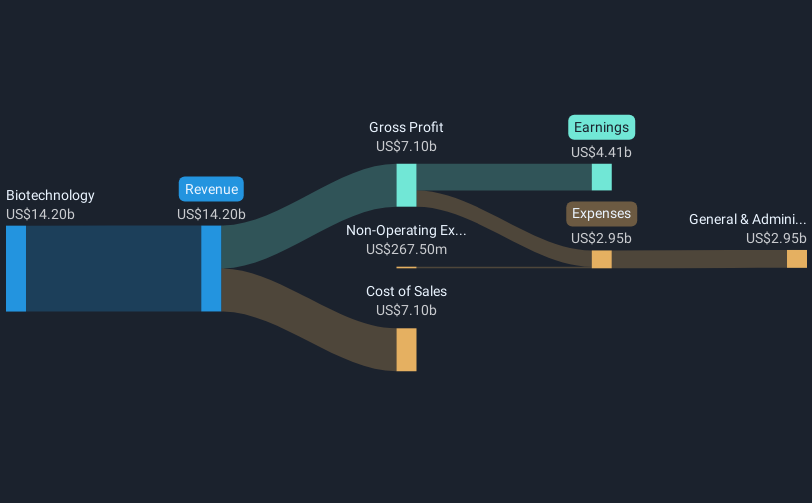

Over the past five years, Regeneron's total shareholder return, which includes both share price appreciation and dividends, was 2.68%. This modest return suggests limited growth in shareholder value over a significant period, especially when juxtaposed against the company's short-term share price decline of 2% and the broader positive market movements. Over the last year, Regeneron underperformed both the US biotech industry and the general market, which posted returns of 7.10% and 2.50%, respectively, underscoring the challenges faced by the company in aligning with broader market trends.

With the share price currently at US$557.91, there is room for potential upside when compared to the consensus analyst price target of US$888.25, reflecting a 58% discount. The considerable gap suggests analysts anticipate strong future earnings that the market hasn’t yet priced in. Nevertheless, for investors, it's essential to critically evaluate if the anticipated earnings growth aligns with the current strategic moves and competitive landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com