McDonald's (NYSE:MCD) is facing pressure as the SOC Investment Group urges shareholders to oppose board nominee Paul Walsh at the upcoming annual meeting. Despite this, the company's share price rose by 9% over the last quarter, aligning with broader market trends as the Dow Jones experienced a surge. Key developments such as quarterly earnings, which remained relatively flat compared to the previous year, and the introduction of a $15 billion share buyback program, echoed investor confidence. The company's recent strategic debt issuance also supports its financial maneuvers amidst a recovering market landscape.

Be aware that McDonald's is showing 2 weaknesses in our investment analysis.

Find companies with promising cash flow potential yet trading below their fair value.

The recent opposition to Paul Walsh's board nomination at McDonald's, initiated by the SOC Investment Group, could influence investor sentiment and impact future governance strategies. Despite this, McDonald's shares have remained resilient, gaining 9% over the last quarter. Over the longer term, the company's total return, including share price and dividends, has been strong at 86.37% over five years. This performance contrasts with the broader market, where McDonald's exceeded the US Hospitality industry return over the past year.

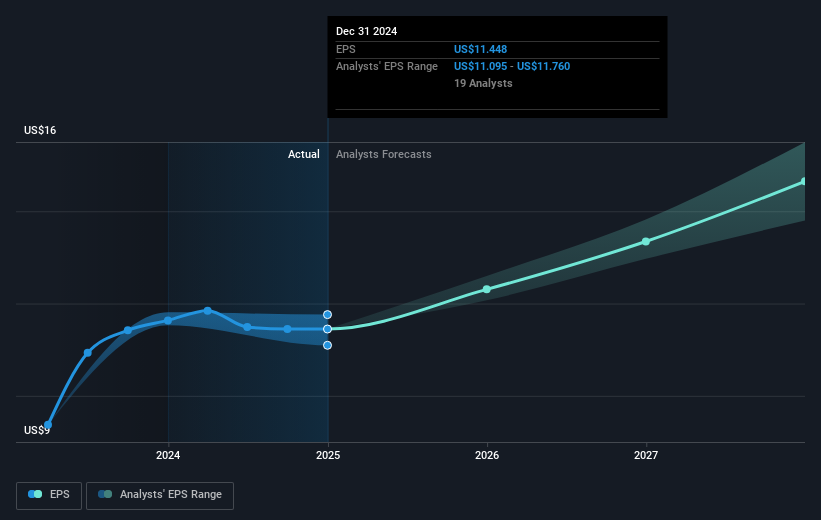

Considering the company's strategic initiatives under the "Accelerating the Arches" strategy, such as value-focused offerings and digital expansion, the current governance challenges could potentially impact revenue and earnings forecasts. Analysts remain optimistic about McDonald's financial health with earnings expected to reach US$10 billion by 2028. The share price currently stands at US$309.1, slightly below the consensus price target of US$327.65, indicating a minor discount. Investors are advised to consider these factors in light of their trust in the management's execution capability and market conditions.

Jump into the full analysis health report here for a deeper understanding of McDonald's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com