Tyson Foods (NYSE:TSN) recently agreed to settle a class-action lawsuit for $83.5 million concerning allegations of price manipulation in the cattle market. Despite this legal challenge, Tyson's share price increased by 8% over the last quarter, a move that aligns with a general uptick in the stock market following recovery from previous declines. Executive changes and dividend affirmations in February also likely contributed positively to shareholder sentiment. These developments, alongside ongoing litigation and the broader market recovery led by a strong Dow Jones performance, provide context for Tyson's market presence amid recent volatility.

Buy, Hold or Sell Tyson Foods? View our complete analysis and fair value estimate and you decide.

With Tyson Foods' recent decision to settle a class-action lawsuit for US$83.5 million concerning price manipulation allegations, investors may evaluate the potential impact on the company's revenue and earnings forecasts. While the settlement could alleviate some legal uncertainties, it might divert resources that could otherwise contribute to operational improvements and strategic initiatives. These include AI-driven efficiencies and supply chain optimizations aimed at enhancing margins and cash flow management, which are critical for maintaining long-term growth trajectories.

When considering the longer-term performance, Tyson's shares have delivered a total return of 17.74% over the past five years, reflecting a combination of share price appreciation and dividends. In contrast, the company underperformed the US market over the past year, which posted a 2.5% gain. This discrepancy highlights Tyson's challenging environment characterized by input cost inflation, cattle supply constraints, and trade risks that have impacted its recent performance relative to broader equity trends.

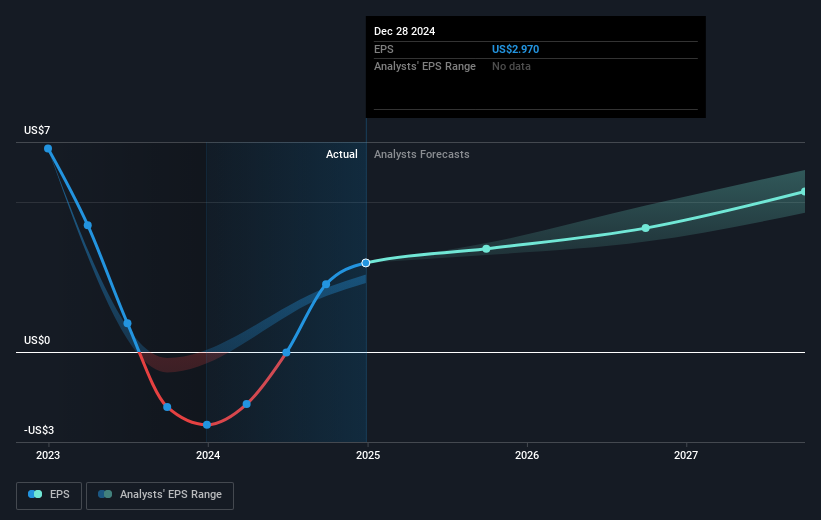

The 8% increase in Tyson's share price over the last quarter places it closer to the consensus analyst price target of US$67.34, yet still about 9.9% below the target. This gap underscores the importance of Tyson realizing its growth projections, with analysts expecting revenue to rise modestly to US$56.0 billion by 2028 and earnings to reach US$2.1 billion. The ongoing execution of digital initiatives and operational improvements, against persistent industry challenges, will be vital in aligning share prices with optimistic market expectations.

Review our historical performance report to gain insights into Tyson Foods' track record.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com