Phillips 66 (NYSE:PSX) has been in the spotlight with its recent announcement urging Elliott Investment Management to halt efforts seen as conflicting with the company's strategic interests, as well as boosting its quarterly dividend by 5 cents. Despite these significant developments, Phillips 66's share price remained flat over the past week, similar to the broader market trend reacting to various macroeconomic factors including uncertain tariff effects. While these events highlight the company's proactive stance on governance and financial returns, they modestly added weight to the overall market sentiment rather than steering its specific downturn or upswing last week.

Phillips 66's recent moves, including urging Elliott Investment Management to halt some actions and increasing the quarterly dividend, illustrate the company’s focus on governance and shareholder returns. Over a five-year horizon, Phillips 66's total shareholder return, including dividends and share price appreciation, reached 88.46%. However, over the past year, the company's performance was not on par with the US Oil and Gas industry, which returned 13.3% less. This discrepancy highlights challenges faced amidst broader industry headwinds.

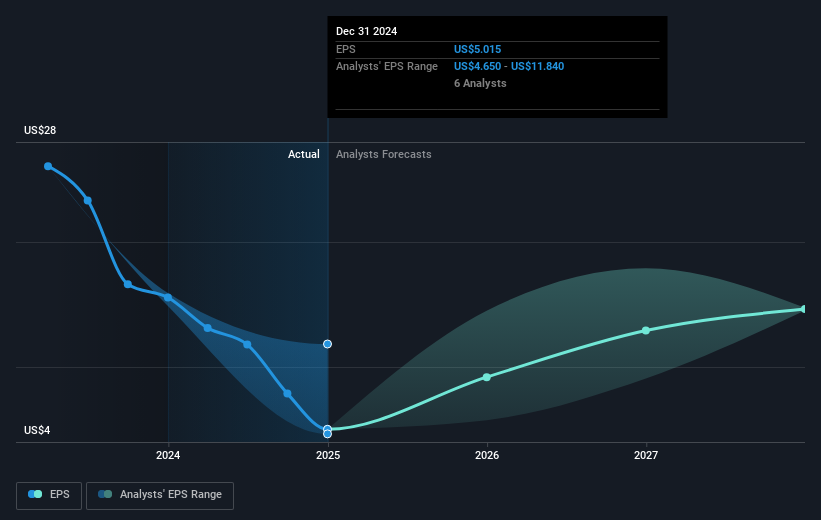

The company’s shareholder-focused initiatives as outlined in the news, such as the dividend hike, could influence revenue and earnings projections by fostering investor confidence in capital allocation strategies. However, the continued challenges such as weak refining margins and high debt levels, which put pressure on net margins, cannot be ignored. The planned refinery closures and asset divestitures could present additional hurdles to future earnings.

With a recent share price of US$96.57 compared to the consensus analyst price target of US$132.29, the company's shares reflect approximately a 27% potential upside. Despite share prices being below analyst targets, investors are advised to consider both current valuations against potential headwinds when assessing Phillips 66’s future outcomes. As the company executes its midstream expansion and mega-projects, these developments will play a crucial role in shaping long-term financial forecasts and supporting the anticipated rise towards analyst targets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com