Royalty Pharma (NasdaqGS:RPRX) recently affirmed its dividend, setting it at $0.22 per Class A ordinary share for the second quarter of 2025, demonstrating its financial stability and commitment to shareholders. The appointment of Vlad Coric to the board, who brings significant expertise in drug development, may further reinforce investor confidence. The company's share price increased by 7% over the last quarter, aligning well with the broader market's recovery as major indices like the Dow surged. These affirmative actions by Royalty Pharma provided positive momentum, countering any fluctuations caused by varied earnings reports across the market.

Be aware that Royalty Pharma is showing 2 possible red flags in our investment analysis.

The recent affirmation of Royalty Pharma's dividend and the appointment of Vlad Coric to the board could have substantial implications for the company's future performance. These moves are likely to strengthen investor confidence, potentially supporting revenue and earnings growth forecasts. The integration of Royalty Pharma's external manager aligns with these efforts, promising significant cost savings and enhanced shareholder value through improved net margins. Looking ahead, the company's expanding pipeline and synthetic royalties could bolster revenue growth.

Over the last year, Royalty Pharma's total return, including share price and dividends, was 19.24%. In the more immediate term, its share price rose 7% in the last quarter, reflecting positive market sentiment. This performance contrasts with the broader US Pharmaceuticals industry, which experienced a 1.2% decline over the same year. Analysts suggest this positive outlook is bolstered by anticipated revenue and earnings growth, potentially validating the consensus price target of US$39.45.

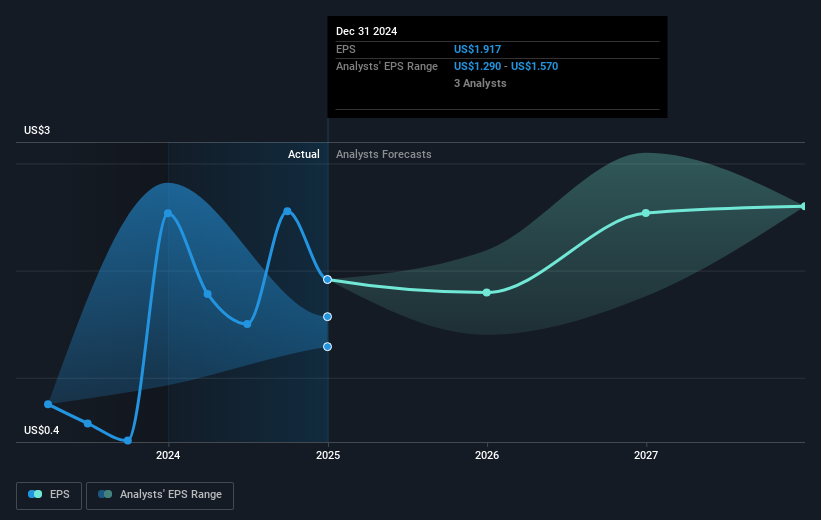

While the current share price is US$32.19, it remains below the consensus target. This implies there is significant upside potential according to analysts. However, the company's reliance on acquisitions and synthetic royalties introduces risks to revenue stability, which could impact these forecasts. Yet, the planned US$2 billion share repurchase in 2025 may also enhance earnings per share and signal management's confidence in the undervaluation of current shares, further influencing the share price toward the target.

Understand Royalty Pharma's earnings outlook by examining our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com