Famed GameStop Corp. (NYSE:GME) short seller, Andrew Left from Citron Research, revealed that he was long China as he discussed his three long positions on Tuesday.

What Happened: Left disclosed that he was long First Solar Inc. (NASDAQ:FSLR), Amazon.com Inc. (NASDAQ:AMZN), and he was also exposed to the Chinese economy and market via his investment in the iShares China Large-Cap ETF (NYSE:FXI), according to a report by Fox Business.

He discussed how these stocks interested him:

First Solar

The U.S. recently unveiled tariffs on solar imports on Monday. This comes after a petitioner group, the American Alliance for Solar Manufacturing Trade Committee, accused Southeast Asian companies of shipping panels priced below their cost of production.

“I thought of the position when the tariff news came, I thought they are going to be the direct beneficiary of it. It’s weird that there was a kind of delayed reaction that Wall Street had today. First Solar makes their solar products in the U.S., and services the U.S.,” said Left

“They have been in constant price wars with Asian manufacturers who are dropping prices. Now, it’s true that they have sold out the capacity right now, but this will get them better pricing power in the future. This was the industry that was needed, especially for data centers,” added Left.

Amazon

Highlighting his rationale for being long Amazon, Left said, “It’s funny when Amazon was $235-$240, just five months ago. I kept saying ‘Oh my god, I can’t believe that I don’t own Amazon, I wish it goes lower.’ Then it goes lower, and you start questioning, Should I buy it?”

“It is Amazon! If the consumer gets stretched, they will still go to Amazon for cheaper prices. If you want to look at dynamic prices, they will be able to navigate their way through tariffs the best, unlike the other competitors,” he said.

Left explained that “When you have market turbulence, and I go to sleep at night knowing that I own Amazon at $172, at one of the lowest PEs, I like the stock right here.”

iShares China Large-Cap ETF

When asked about being long China amid the ongoing tariff battle, he said that the Chinese markets have “held in” despite the turbulence.

“It’s been oversold for a while, China. There’s a lot of catch-up in that market, and the government has finally made a commitment in China to support their own market. They never made that kind of commitment three or four years ago,” he explained.

“Multiples in China are very low, it is a large economy. And hopefully, think of the catalyst of the potential trade deal with the U.S. Think of the impact on this market that hasn’t had repressed pricing for so long,” Left said.

Why It Matters: Left is long Amazon despite a negative year-to-date performance of 21.36% and lower by 3.54% over a year.

Meanwhile, First Solar was down 27.41% YTD and 24.85% over one year. On the other hand, iShares China Large-Cap ETF was higher by 11.94% YTD and 34.92% over a year.

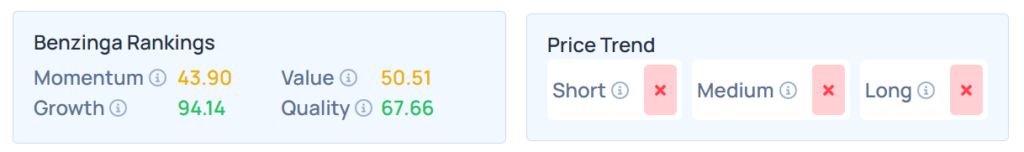

Benzinga Edge Stock Rankings indicate that AMZN has a weaker price trend over the short, medium, and long term. Its momentum ranking was moderate at the 43.90th percentile, whereas its value rankings, growth, and quality rankings were stronger; more details are available here.

Benzinga Edge Stock Rankings shows that FSLR also has a weaker price trend over the short, medium, and long term. Its momentum ranking was very weak at the 18.27th percentile, whereas its value ranking was strong at 72.40th percentile, the details for which, along with other metrics, are available here.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, rose on Thursday. The SPY was up 2.60% to $527.25, while the QQQ advanced 2.63% to $444.48, according to Benzinga Pro data.

Read Next:

Photo courtesy: Markus Mainka / Shutterstock.com