Oxford Industries (NYSE:OXM) underwent analysis by 6 analysts in the last quarter, revealing a spectrum of viewpoints from bullish to bearish.

In the table below, you'll find a summary of their recent ratings, revealing the shifting sentiments over the past 30 days and comparing them to the previous months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 1 | 4 | 0 | 1 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 3 | 0 | 1 |

| 2M Ago | 0 | 1 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

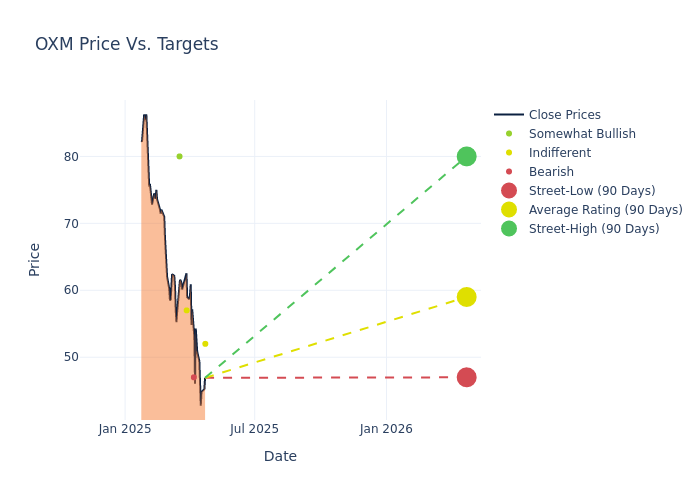

Insights from analysts' 12-month price targets are revealed, presenting an average target of $61.33, a high estimate of $80.00, and a low estimate of $47.00. Observing a downward trend, the current average is 14.62% lower than the prior average price target of $71.83.

Deciphering Analyst Ratings: An In-Depth Analysis

The analysis of recent analyst actions sheds light on the perception of Oxford Industries by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating |Current Price Target| Prior Price Target | |--------------------|---------------------|---------------|---------------|--------------------|--------------------| |Dana Telsey |Telsey Advisory Group|Lowers |Market Perform | $52.00|$64.00 | |Paul Lejuez |Citigroup |Lowers |Sell | $47.00|$52.00 | |Mauricio Serna |UBS |Lowers |Neutral | $57.00|$66.00 | |Dana Telsey |Telsey Advisory Group|Lowers |Market Perform | $64.00|$68.00 | |Dana Telsey |Telsey Advisory Group|Lowers |Market Perform | $68.00|$86.00 | |Alex Markgraff |Keybanc |Lowers |Overweight | $80.00|$95.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Oxford Industries. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Analyzing trends, analysts offer qualitative evaluations, ranging from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Oxford Industries compared to the broader market.

- Price Targets: Analysts provide insights into price targets, offering estimates for the future value of Oxford Industries's stock. This comparison reveals trends in analysts' expectations over time.

To gain a panoramic view of Oxford Industries's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on Oxford Industries analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

All You Need to Know About Oxford Industries

Oxford Industries Inc is an apparel manufacturing company that designs, sources, markets, and distributes products under the brand name Tommy Bahama, and Lilly Pulitzer. Tommy Bahama designs, sources, markets, and distributes men's and women's sportswear and related products. Lilly Pulitzer designs, sources, markets, and distributes upscale collections of women's and women's dresses, sportswear, and related products. The company generates majority of its revenue from the Tommy Bahama division.

Oxford Industries's Economic Impact: An Analysis

Market Capitalization Analysis: Below industry benchmarks, the company's market capitalization reflects a smaller scale relative to peers. This could be attributed to factors such as growth expectations or operational capacity.

Revenue Growth: Oxford Industries's revenue growth over a period of 3M has faced challenges. As of 31 January, 2025, the company experienced a revenue decline of approximately -3.44%. This indicates a decrease in the company's top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Consumer Discretionary sector.

Net Margin: Oxford Industries's net margin is impressive, surpassing industry averages. With a net margin of 4.58%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Oxford Industries's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 2.9%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): Oxford Industries's ROA excels beyond industry benchmarks, reaching 1.42%. This signifies efficient management of assets and strong financial health.

Debt Management: With a below-average debt-to-equity ratio of 0.72, Oxford Industries adopts a prudent financial strategy, indicating a balanced approach to debt management.

The Basics of Analyst Ratings

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.