As the U.S. market experiences a surge in optimism following eased tariff concerns and reassurances on Federal Reserve independence, major indices like the S&P 500 and Nasdaq Composite have seen significant gains, reflecting a renewed risk appetite among investors. In this environment, identifying undiscovered gems—stocks that may not yet be on every investor's radar but possess strong fundamentals and growth potential—can offer intriguing opportunities for those looking to navigate the evolving economic landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 9.72% | 4.94% | 6.51% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Cashmere Valley Bank | 15.62% | 5.80% | 3.51% | ★★★★★★ |

| Omega Flex | NA | -0.52% | 0.74% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.47% | -26.86% | ★★★★★★ |

| Teekay | NA | -0.89% | 62.53% | ★★★★★★ |

| Solesence | 33.45% | 23.87% | -3.75% | ★★★★★★ |

| Anbio Biotechnology | NA | 8.43% | 184.88% | ★★★★★★ |

| FRMO | 0.09% | 44.64% | 49.91% | ★★★★★☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Esquire Financial Holdings (NasdaqCM:ESQ)

Simply Wall St Value Rating: ★★★★★★

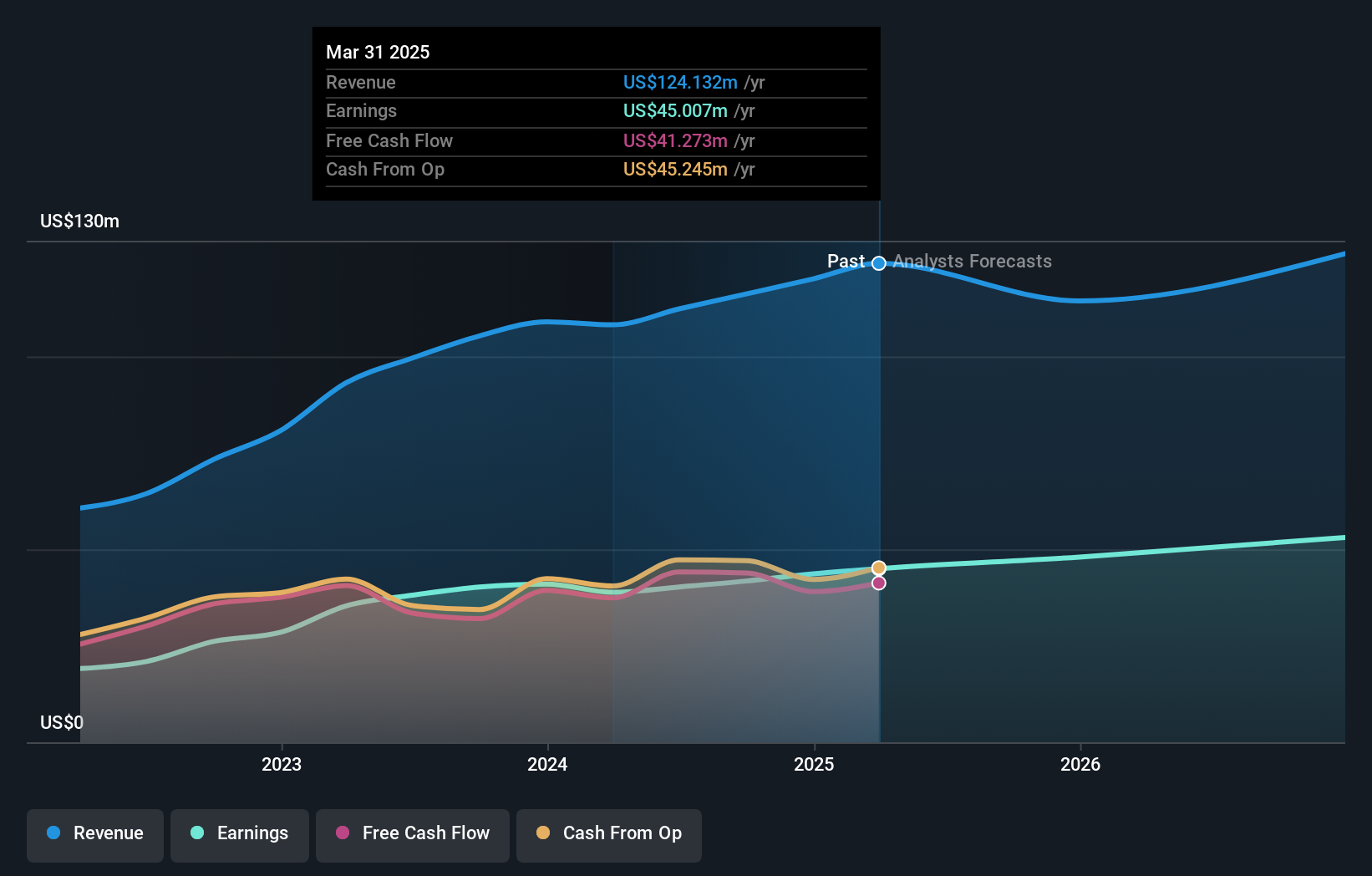

Overview: Esquire Financial Holdings, Inc. is a bank holding company for Esquire Bank, National Association, offering commercial banking products and services to legal and small businesses as well as commercial and retail customers in the United States, with a market cap of $628.37 million.

Operations: Esquire Financial Holdings generates revenue primarily through its community banking segment, which reported $120.12 million. The company's financial performance is influenced by its ability to manage costs and optimize profit margins effectively.

Esquire Financial Holdings, with assets totaling $1.9 billion and equity of $237.1 million, stands out for its robust financial health. Its liabilities are predominantly low-risk, primarily funded by customer deposits rather than external borrowing. The bank's bad loans ratio is just 0.8%, backed by a substantial allowance of 192%. Esquire's earnings growth outpaced the industry at 6.5% last year, and it trades at a significant discount to estimated fair value—56.8% below it—suggesting potential for investors seeking undervalued opportunities in the banking sector.

Buckle (NYSE:BKE)

Simply Wall St Value Rating: ★★★★★★

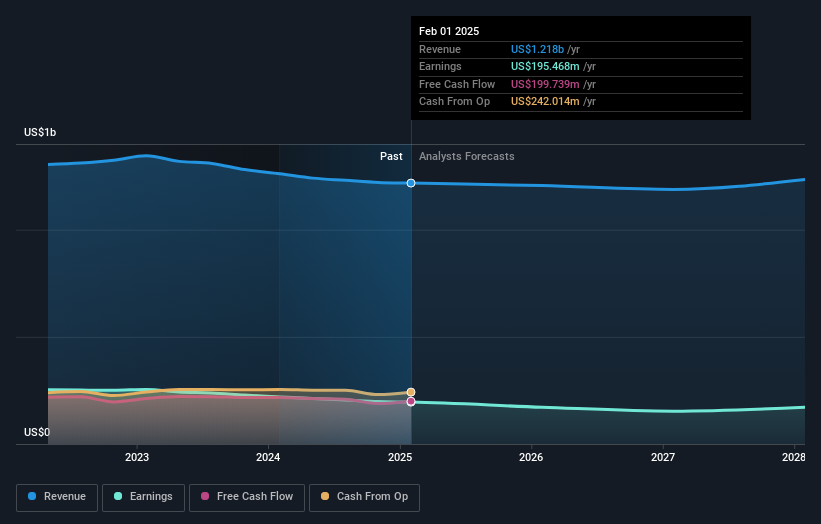

Overview: The Buckle, Inc. is a U.S.-based retailer specializing in casual apparel, footwear, and accessories for men, women, and kids under the Buckle and Buckle Youth brands with a market cap of approximately $1.72 billion.

Operations: Buckle generates revenue primarily from the sale of casual apparel, footwear, and accessories, totaling approximately $1.22 billion.

Buckle, known for its casual apparel and accessories, is navigating a challenging landscape with strategic shifts. Despite a recent uptick in net sales by 4.5% to US$109.1 million over a 5-week period ending April 2025, the company faces headwinds with an earnings drop of 11.2% compared to last year. Trading at nearly half its estimated fair value and remaining debt-free for five years underscores its financial prudence, yet declining profit margins and reliance on Chinese inventory could impact future performance. While digital expansion offers growth potential, analysts foresee modest revenue growth at 2.7% annually amid operational cost pressures.

La-Z-Boy (NYSE:LZB)

Simply Wall St Value Rating: ★★★★★★

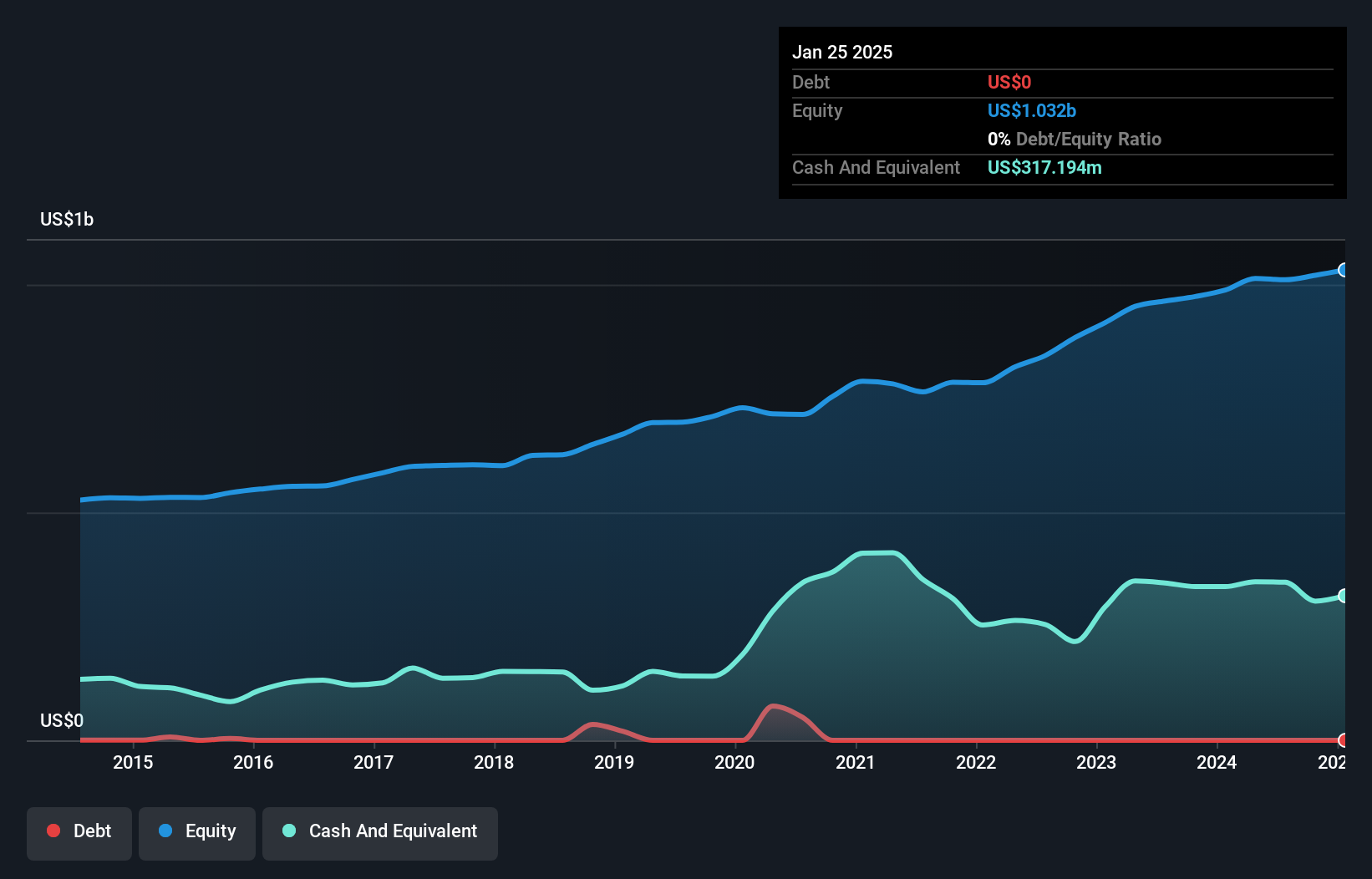

Overview: La-Z-Boy Incorporated is a company that manufactures, markets, imports, exports, distributes, and retails upholstery furniture products in the United States, Canada, and internationally with a market cap of approximately $1.56 billion.

Operations: La-Z-Boy generates revenue primarily from its wholesale segment at $1.47 billion and retail segment at $879.48 million, with a deduction for eliminations amounting to $418.67 million.

La-Z-Boy, a company with high-quality earnings, is trading at 34.7% below its estimated fair value and has seen a 9.7% annual growth in earnings over the past five years. Despite being debt-free and maintaining a positive free cash flow of US$136.71 million as of July 2023, it faces challenges from market conditions like low home sales and high mortgage rates which could pressure margins currently at 5.9%. Strategic initiatives such as retail expansion under the Century Vision strategy aim to double market growth rates, projecting revenue increases by about 3% annually over the next three years with profit margins potentially rising to 6.6%.

Taking Advantage

- Discover the full array of 290 US Undiscovered Gems With Strong Fundamentals right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com