Intuitive Surgical Inc (NASDAQ:ISRG) reported better-than-expected first-quarter financial results Tuesday after the bell.

Intuitive Surgical reported first-quarter revenue of $2.25 billion, beating analyst estimates of $2.19 billion, according to Benzinga Pro. The robotic-assisted surgery company reported first-quarter adjusted earnings of $1.81 per share, beating analyst estimates of $1.72 per share.

"Core measures of our business were healthy this quarter, and we are pleased by continued customer adoption of our platforms, including da Vinci 5. As we look ahead, we remain focused on enabling our customers to deliver on their goals: better patient outcomes, improved patient and care team experiences, lower total cost to treat, and increased access to care," said Gary Guthart, CEO of Intuitive Surgical.

Intuitive Surgical expects full-year 2025 worldwide da Vinci procedures to increase approximately 15% to 17%. The company expects gross profit margin to be between 65% and 66.5% of revenue in 2025, which includes an estimated 1.7% impact from tariffs.

Intuitive Surgical shares gained 3% to trade at $492.96 on Wednesday.

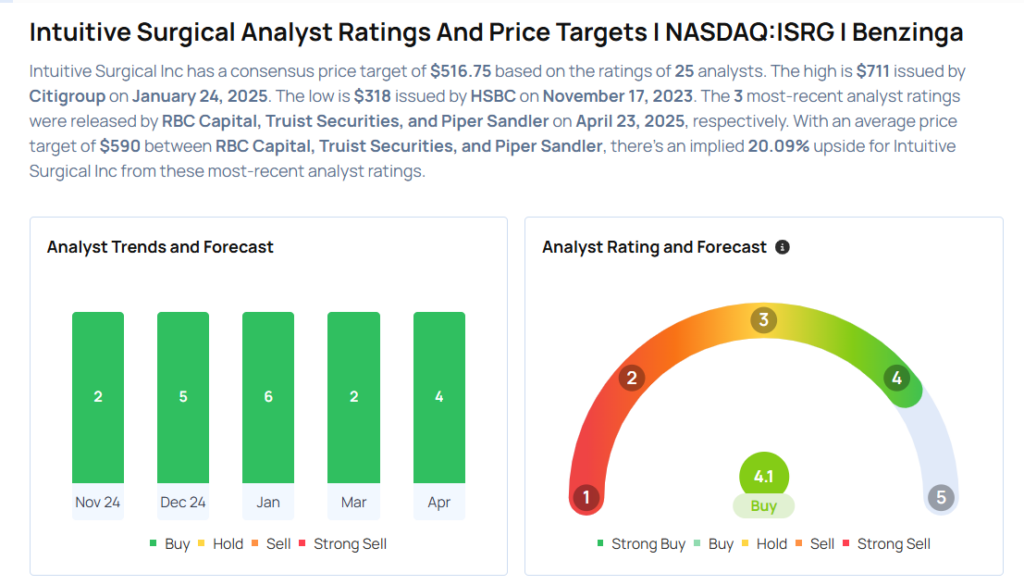

These analysts made changes to their price targets on Intuitive Surgical following earnings announcement.

- Baird analyst David Rescott maintained Intuitive Surgical with an Outperform rating and lowered the price target from $600 to $575.

- Evercore ISI Group analyst Vijay Kumar maintained the stock with an In-Line rating and lowered the price target from $510 to $470.

- Piper Sandler analyst Adam Maeder maintained Intuitive Surgical with an Overweight rating and lowered the price target from $670 to $575.

- Truist Securities analyst Richard Newitter maintained the stock with a Buy rating and cut the price target from $605 to $590.

- RBC Capital analyst Shagun Singh maintained Intuitive Surgical with an Outperform rating and lowered the price target from $630 to $605..

Considering buying ISRG stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock