On Wednesday, Cathie Wood-led Ark Invest increased its exposure to NVIDIA Corp (NASDAQ:NVDA) and Advanced Micro Devices Inc (NASDAQ:AMD). These trades come amid ongoing challenges in the semiconductor industry, particularly with U.S. sanctions affecting chip sales to China.

The Nvidia Trade saw Ark Invest’s ARK Autonomous Technology & Robotics ETF (BATS:ARKQ) acquiring 4,731 shares of NVIDIA. The stock closed at $102.71, marking a 3.86% increase from the previous day. The total value of this trade amounted to approximately $485,921.This purchase reflects Ark’s confidence in NVIDIA’s potential, even as Chinese tech giants like Alibaba and Tencent stockpile NVIDIA’s AI chips due to U.S. sanctions. These chips, specifically the H20 models, were designed to meet U.S. regulatory requirements, yet the looming threat of shipment restrictions has led to a surge in demand from Chinese companies.

The AMD Trade involved Ark’s ARKQ ETF purchasing 1,808 shares of Advanced Micro Devices. AMD’s stock saw a 4.79% rise, closing at $90.39. This acquisition, valued at around $163,425, comes as Ark continues to bolster its position in the semiconductor sector. On Tuesday, Ark had scooped up AMD shares worth $2.14 million while picking Nvidia stock worth $1.09 million. Both these companies face U.S. export restrictions targeting China.

Other Key Trades:

- Sold 182 Microsoft (MSFT) shares through ARKW

- Sold 40,015 shares of UiPath Inc (NYSE:PATH) from ARKF ETF and 8,273 shares through ARKW.

- Bought 104,048 shares of Nurix Therapeutics Inc (NASDAQ:NRIX) through ARKG.

- Sold 147,820 shares of Adaptive Biotechnologies Corp (NASDAQ:ADPT) in ARKG ETF.

- Purchased 80,661 shares of 10X Genomics Inc (NASDAQ:TXG) via ARKG ETF.

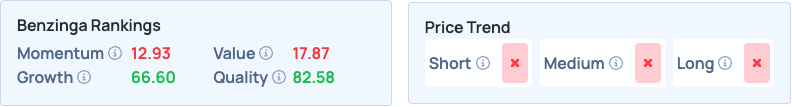

Benzinga Edge Stock Rankings show AMD has a Momentum in the 12th percentile and Growth in the 66th percentile. Wondering how Nvidia is placed? Click here for the full picture.

Photo Courtesy: T. Schneider on Shutterstock.com

Read Next:

This story was generated using Benzinga Neuro and edited by Shivdeep Dhaliwal