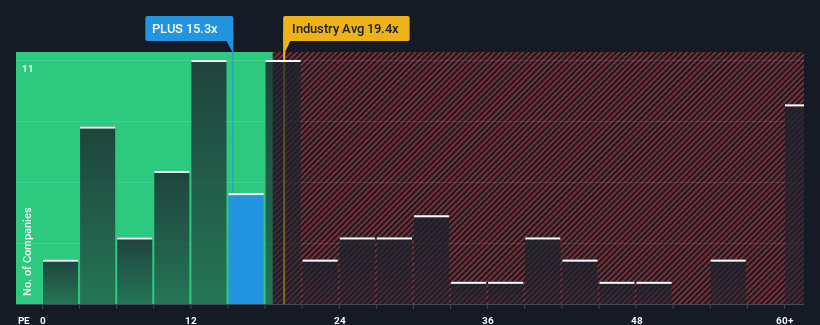

There wouldn't be many who think ePlus inc.'s (NASDAQ:PLUS) price-to-earnings (or "P/E") ratio of 15.3x is worth a mention when the median P/E in the United States is similar at about 17x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

We check all companies for important risks. See what we found for ePlus in our free report.ePlus hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It might be that many expect the dour earnings performance to strengthen positively, which has kept the P/E from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

View our latest analysis for ePlus

What Are Growth Metrics Telling Us About The P/E?

In order to justify its P/E ratio, ePlus would need to produce growth that's similar to the market.

Retrospectively, the last year delivered a frustrating 17% decrease to the company's bottom line. That put a dampener on the good run it was having over the longer-term as its three-year EPS growth is still a noteworthy 9.4% in total. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been mostly respectable for the company.

Looking ahead now, EPS is anticipated to slump, contracting by 2.3% during the coming year according to the two analysts following the company. With the market predicted to deliver 13% growth , that's a disappointing outcome.

In light of this, it's somewhat alarming that ePlus' P/E sits in line with the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining earnings are likely to weigh on the share price eventually.

The Final Word

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that ePlus currently trades on a higher than expected P/E for a company whose earnings are forecast to decline. Right now we are uncomfortable with the P/E as the predicted future earnings are unlikely to support a more positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for ePlus with six simple checks.

You might be able to find a better investment than ePlus. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.