Unfortunately for some shareholders, the Atlas Energy Solutions Inc. (NYSE:AESI) share price has dived 26% in the last thirty days, prolonging recent pain. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 39% share price drop.

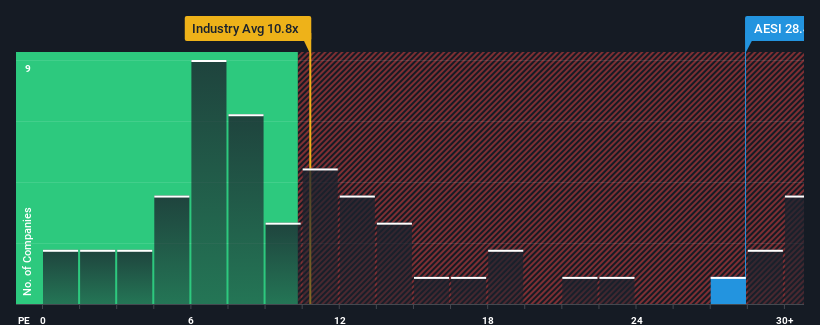

In spite of the heavy fall in price, Atlas Energy Solutions may still be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 28.4x, since almost half of all companies in the United States have P/E ratios under 16x and even P/E's lower than 10x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

While the market has experienced earnings growth lately, Atlas Energy Solutions' earnings have gone into reverse gear, which is not great. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

See our latest analysis for Atlas Energy Solutions

How Is Atlas Energy Solutions' Growth Trending?

Atlas Energy Solutions' P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Retrospectively, the last year delivered a frustrating 63% decrease to the company's bottom line. However, a few very strong years before that means that it was still able to grow EPS by an impressive 5,101% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Looking ahead now, EPS is anticipated to climb by 44% per annum during the coming three years according to the eight analysts following the company. That's shaping up to be materially higher than the 10% each year growth forecast for the broader market.

With this information, we can see why Atlas Energy Solutions is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

A significant share price dive has done very little to deflate Atlas Energy Solutions' very lofty P/E. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Atlas Energy Solutions' analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

It is also worth noting that we have found 3 warning signs for Atlas Energy Solutions (1 can't be ignored!) that you need to take into consideration.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.