Top 2 Defensive Stocks You May Want To Dump This Quarter

Benzinga · 16h ago

Share

Listen to the news

As of April 24, 2025, two stocks in the consumer staples sector could be flashing a real warning to investors who value momentum as a key criteria in their trading decisions.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered overbought when the RSI is above 70, according to Benzinga Pro.

Here's the latest list of major overbought players in this sector.

Fresh Del Monte Produce Inc (NYSE:FDP)

- Fresh Del Monte Produce will issue a press release on its first quarter financial results before the opening bell on Wednesday, April 30. The company's stock jumped around 17% over the past month and has a 52-week high of $35.27.

- RSI Value: 77.7

- FDP Price Action: Shares of Fresh Del Monte Produce gained 1.5% to close at $34.28 on Wednesday.

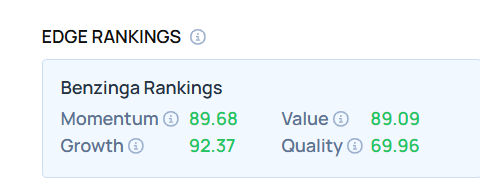

- Edge Stock Ratings: 89.68 Momentum score with Value at 89.09.

Philip Morris International Inc. (NYSE:PM)

- On April 23, Philip Morris International reported better-than-expected first-quarter financial results and raised its FY25 adjusted EPS guidance above estimates. The tobacco giant's revenue increased 5.8% year over year to $9.30 billion, beating the analyst consensus estimate of $9.12 billion. Adjusted EPS of $1.69 beat the consensus estimate of $1.61. The company's stock gained around 11% over the past month and has a 52-week high of $171.63.

- RSI Value: 73.2

- PM Price Action: Shares of Philip Morris rose 2.5% to close at $168.11 on Wednesday.

Curious about other BZ Edge Rankings? Click here to discover how similar stocks measure up.

Read This Next:

Photo via Shutterstock

Disclaimer:This article represents the opinion of the author only. It does not represent the opinion of Webull, nor should it be viewed as an indication that Webull either agrees with or confirms the truthfulness or accuracy of the information. It should not be considered as investment advice from Webull or anyone else, nor should it be used as the basis of any investment decision.

What's Trending

No content on the Webull website shall be considered a recommendation or solicitation for the purchase or sale of securities, options or other investment products. All information and data on the website is for reference only and no historical data shall be considered as the basis for judging future trends.

Copyright © 2025 Webull. All Rights Reserved