Over the last 7 days, the United States market has risen by 2.3%, contributing to a 5.9% increase over the past year, with earnings projected to grow by 14% annually. In this environment of steady growth, identifying stocks that are trading below their intrinsic value can present opportunities for investors seeking potential gains in undervalued assets.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Renasant (NYSE:RNST) | $31.11 | $60.65 | 48.7% |

| MetroCity Bankshares (NasdaqGS:MCBS) | $28.41 | $56.26 | 49.5% |

| Royal Caribbean Cruises (NYSE:RCL) | $207.50 | $403.26 | 48.5% |

| CI&T (NYSE:CINT) | $5.16 | $10.15 | 49.1% |

| Shift4 Payments (NYSE:FOUR) | $80.22 | $158.37 | 49.3% |

| Curbline Properties (NYSE:CURB) | $23.40 | $46.01 | 49.1% |

| Verra Mobility (NasdaqCM:VRRM) | $22.25 | $43.26 | 48.6% |

| RXO (NYSE:RXO) | $13.40 | $26.30 | 49.1% |

| First Advantage (NasdaqGS:FA) | $13.87 | $27.25 | 49.1% |

| CNX Resources (NYSE:CNX) | $30.59 | $60.39 | 49.3% |

Here we highlight a subset of our preferred stocks from the screener.

Analog Devices (NasdaqGS:ADI)

Overview: Analog Devices, Inc. designs, manufactures, tests, and markets integrated circuits, software, and subsystems products globally with a market cap of approximately $88.53 billion.

Operations: The company generates revenue of $9.34 billion from designing, developing, manufacturing, and marketing a broad range of integrated circuits.

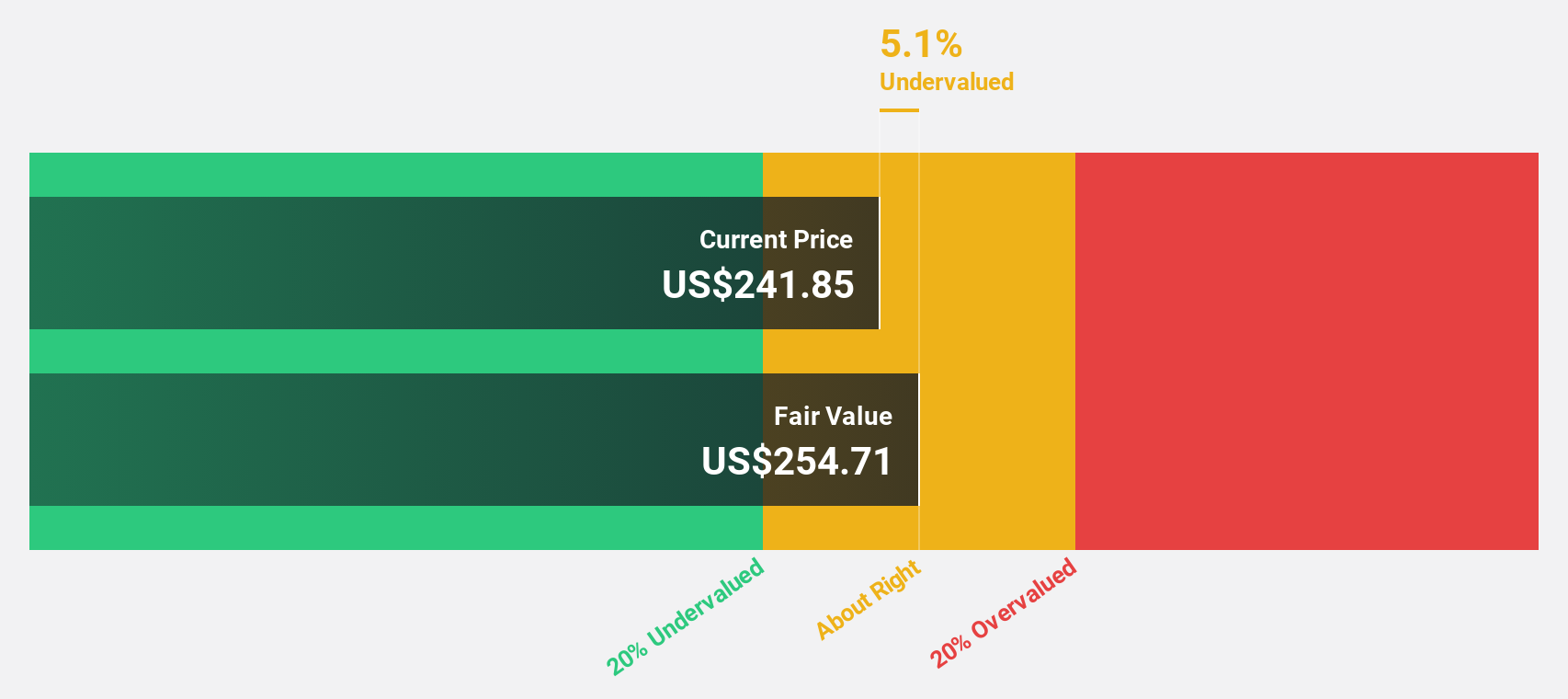

Estimated Discount To Fair Value: 25%

Analog Devices is trading at US$183.11, approximately 25% below its estimated fair value of US$243.99, suggesting it may be undervalued based on cash flows. Despite a decline in profit margins from 24.4% to 16.7%, earnings are forecast to grow significantly at 24.8% annually, outpacing the broader market's growth rate of 14.1%. However, recent insider selling and a dividend not fully covered by earnings could be potential concerns for investors considering this stock's valuation metrics and growth prospects.

- According our earnings growth report, there's an indication that Analog Devices might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of Analog Devices.

Oracle (NYSE:ORCL)

Overview: Oracle Corporation provides products and services for enterprise information technology environments globally, with a market cap of approximately $356.81 billion.

Operations: Oracle's revenue is primarily derived from three segments: Cloud and License at $47.60 billion, Services at $5.26 billion, and Hardware at $2.93 billion.

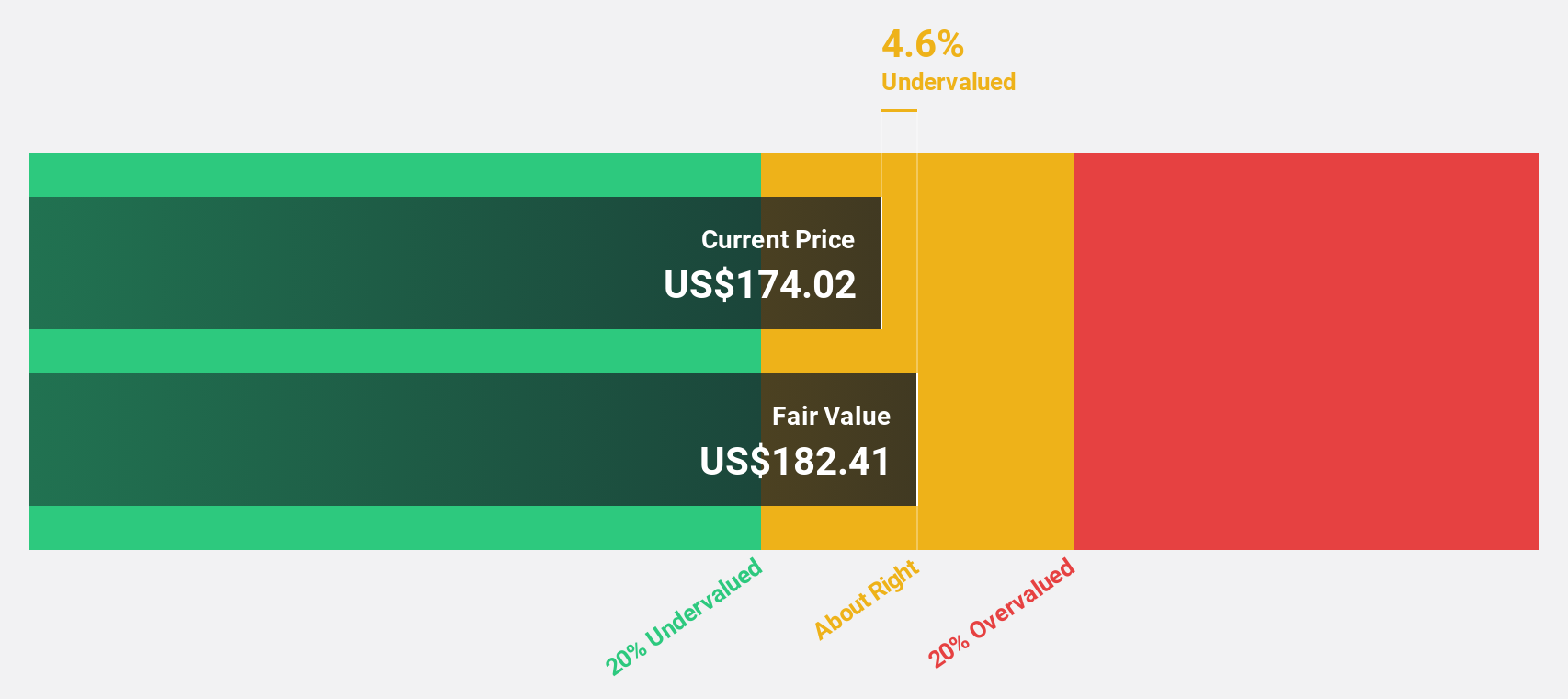

Estimated Discount To Fair Value: 44.5%

Oracle is trading at US$131.4, significantly below its estimated fair value of US$236.65, suggesting it may be undervalued based on cash flows. Recent contracts with the U.S. Department of Defense and USDA highlight Oracle's strong market position in cloud services, potentially bolstering future cash flows. However, its high debt levels could pose a risk despite expected earnings growth of 16.6% annually, which surpasses the U.S market's average growth rate of 14.1%.

- The analysis detailed in our Oracle growth report hints at robust future financial performance.

- Get an in-depth perspective on Oracle's balance sheet by reading our health report here.

Royal Caribbean Cruises (NYSE:RCL)

Overview: Royal Caribbean Cruises Ltd. operates as a global cruise company with a market capitalization of approximately $53.74 billion.

Operations: The company generates its revenue primarily from its cruise lines, amounting to $16.49 billion.

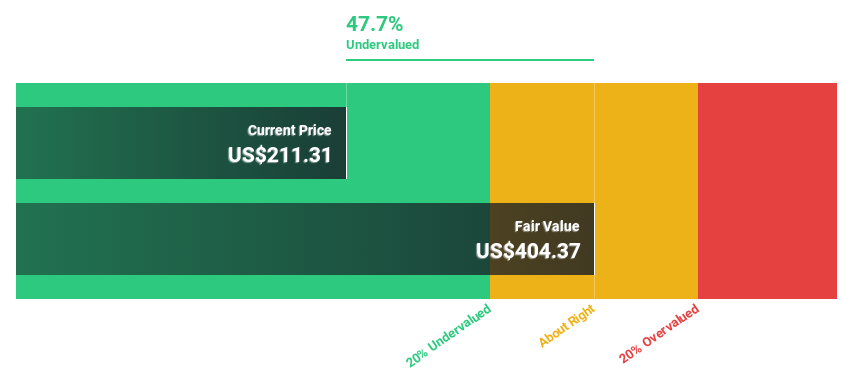

Estimated Discount To Fair Value: 48.5%

Royal Caribbean Cruises, trading at US$207.5, is significantly below its estimated fair value of US$403.26, highlighting potential undervaluation based on cash flows. Despite a high debt level and recent significant insider selling, the company forecasts robust earnings growth of 15.4% annually, outpacing the U.S market average. Recent financial results show strong performance with net income doubling year-on-year to US$553 million in Q4 2024. Additionally, a share repurchase program worth up to $1 billion has been announced.

- Upon reviewing our latest growth report, Royal Caribbean Cruises' projected financial performance appears quite optimistic.

- Navigate through the intricacies of Royal Caribbean Cruises with our comprehensive financial health report here.

Summing It All Up

- Gain an insight into the universe of 186 Undervalued US Stocks Based On Cash Flows by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com