Robert Half Inc. (NYSE:RHI) reported worse-than-expected first-quarter financial results on Wednesday.

Robert Half posted quarterly earnings of 17 cents per share, missing market estimates of 36 cents per share. The company's quarterly sales came in at $1.35 billion missing estimates of $1.41 billion.

“For the first quarter of 2025, global enterprise revenues were $1.352 billion, down 8 percent from last year’s first quarter on a reported basis, and down 6 percent on an adjusted basis. Business confidence levels moderated during the quarter in response to heightened economic uncertainty over U.S. trade and other policy developments. Client and job seeker caution continues to elongate decision cycles and subdue hiring activity and new project starts,” said M. Keith Waddell, president and chief executive officer at Robert Half. “Despite the uncertain outlook, we are very well-positioned to capitalize on emerging opportunities and support our clients’ talent and consulting needs through the strength of our industry-leading brand, our people, our technology and our unique business model that includes both professional staffing and business consulting services. “

Robert Half shares fell 4.1% to trade at $44.54 on Thursday.

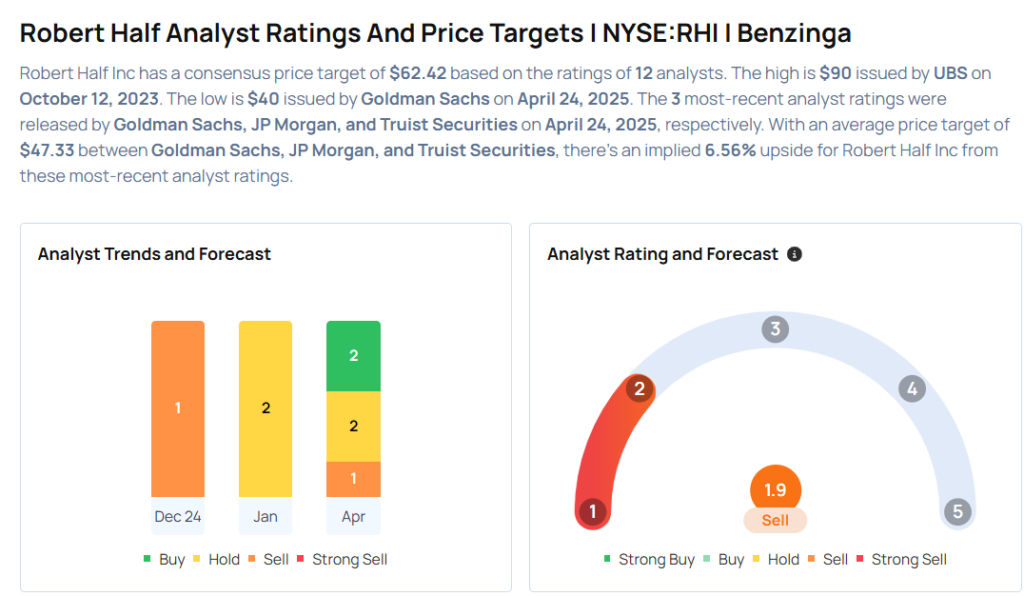

These analysts made changes to their price targets on Robert Half following earnings announcement.

- Truist Securities analyst Tobey Sommer maintained Robert Half with a Buy and lowered the price target from $60 to $55.

- JP Morgan analyst Andrew Steinerman maintained the stock with a Neutral and lowered the price target from $65 to $47.

- Goldman Sachs analyst George Tong maintained Robert Half with a Sell and cut the price target from $46 to $40.

Considering buying RHI stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock