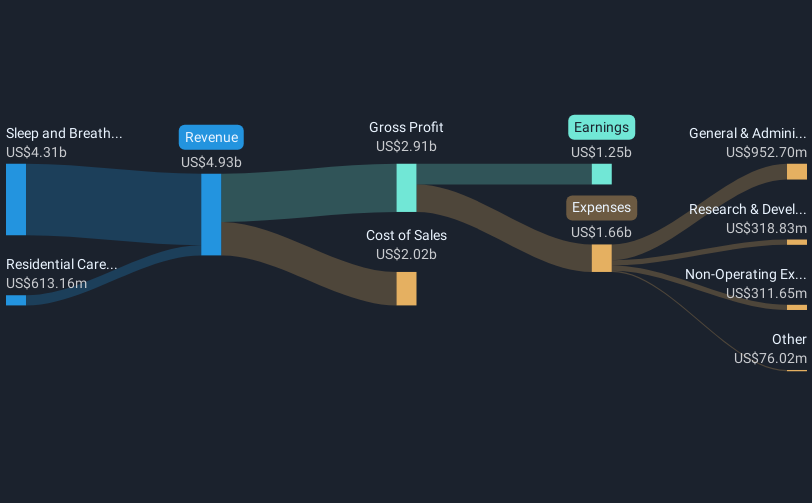

Recently, ResMed (NYSE:RMD) reported solid financial performance for the quarter ending March 31, 2025, with sales increasing to $1,292 million and net income reaching $365 million year-over-year. The company declared a quarterly cash dividend of $0.53 per share. Despite a 1.39% share price increase over the last week, ResMed's movement was relatively subdued compared to broader market gains, with major indexes like the Nasdaq rising notably amid a tech rally. The positive earnings report and dividend declaration likely contributed to investor confidence, even in the face of broader market trends influenced by external economic news.

Buy, Hold or Sell ResMed? View our complete analysis and fair value estimate and you decide.

The recent news of ResMed's strong quarterly performance, with sales hitting US$1.29 billion and net income at US$365 million, alongside a declared dividend of US$0.53 per share, reflects positively on the company's growth narrative. The global rollout of AirSense 11 and partnerships with tech giants like Apple are anticipated to enhance market presence and revenue streams. These developments suggest potential boosts in long-term earnings, aligning with analyst forecasts of increased profit margins and earnings growth over the next few years.

Over the past five years, ResMed shares have delivered a total return, including both price appreciation and dividends, of 43.12%. In comparison, within the last year alone, ResMed outperformed the US Medical Equipment industry, which returned 3.4%. This longer-term performance exemplifies ResMed's ability to maintain steady growth and deliver value to shareholders despite short-term market fluctuations.

The current share price of US$214.08 contrasts with the consensus analyst price target of US$265.42, representing a potential upside. However, opinions vary significantly among analysts, reflecting different assumptions about future growth, profit margins, and industry challenges. With ResMed trading below both the analyst price target and its fair value estimate of US$313.58, the market may be undervaluing the company's potential, particularly in light of its recent strategic innovations and partnerships. Shareholders should consider these factors alongside potential risks, such as foreign currency fluctuations and increased competition, when evaluating future performance.

Our valuation report here indicates ResMed may be undervalued.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com