Kimberly-Clark (NYSE:KMB) has attracted attention with mergers and acquisition rumors concerning its international tissue business, which drew bids from major players like Royal Golden Eagle and Suzano. This development, part of a broader restructuring strategy, coincides with the company's share price increase of 3% over the last quarter. Despite challenging earnings, including a dip in sales and net income, the bid interest may have supported investor sentiment. Amid broader market gains and mixed reactions to tariffs, these events provided a backdrop to Kimberly-Clark's performance, subtly aligning with market trends rather than diverging dramatically.

We've spotted 2 risks for Kimberly-Clark you should be aware of.

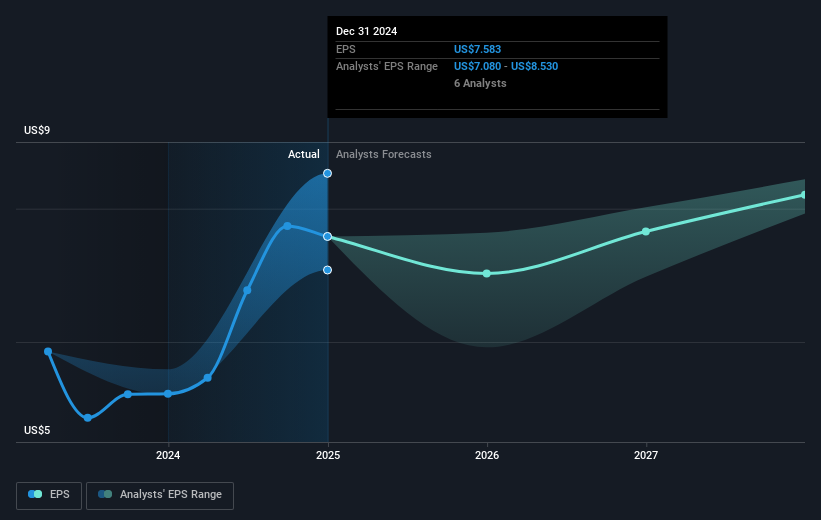

The recent merger and acquisition rumors surrounding Kimberly-Clark, particularly its international tissue business, could have far-reaching implications for its growth strategy and financial performance. As part of the broader Powering Care initiative, such moves might bolster product differentiation and efficiency, potentially supporting the company's revenue and earnings forecasts. The interest from major players like Royal Golden Eagle and Suzano may enhance investor confidence and positively impact these forecasts. Analysts project earnings to increase from US$2.47 billion, supported by supply chain improvements and cost optimizations, despite challenging market environments.

Over the past five years, Kimberly-Clark’s total return, including share price and dividends, amounted to 13.72%. This puts the company's performance in a favorable light over a longer horizon. However, in the last year, Kimberly-Clark underperformed the broader US market's 7.9% return, though it matched the US Household Products industry's 2.5% decline. This context underscores the challenges it faces even as it strives to align with evolving market dynamics.

Currently, Kimberly-Clark shares are trading at US$137.92, which is a 5.4% discount to the analyst consensus price target of US$145.84. This modest discount reflects a relative consensus that the stock is fairly valued, though perspectives vary with target prices ranging from US$118.0 to US$168.0. Collectively, these elements highlight a complex narrative where operational changes and market conditions may significantly influence Kimberly-Clark's financial trajectory moving forward.

Dive into the specifics of Kimberly-Clark here with our thorough balance sheet health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com